Landlord’s of Shopping Centers…Listen Up

Thursday, September 17th, 2009Successful Leasing Strategies in a Volatile Market

This International Council of Shopping Centers (ICSC) held a webinar his past week called “Successful Leasing Strategies in a Volatile Market” which consisted of a panel of industry experts who gave their professional opinion on the most effective leasing strategies in the current market situations.

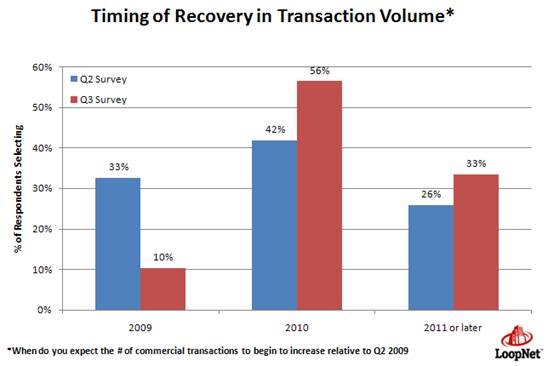

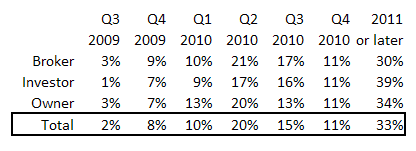

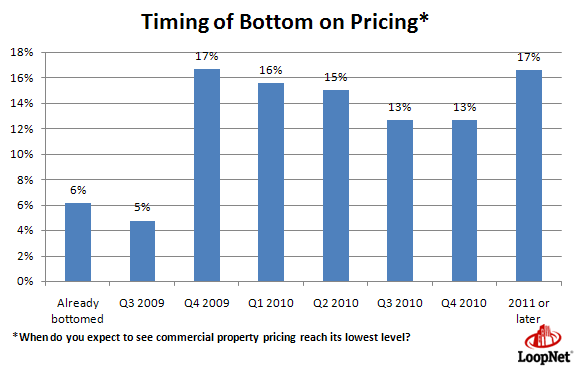

Hessman Nadji opened up the session with an overview of the driving economic forces in today’s market, and addressed his predictions on the future recovery, Nadji stated “There is plenty of positive evidence that suggests the worst is over in what is now being called the “Great Recession,” but stated that there are still plenty of obstacles before us.

“We’ve seen the steepest job loss since the great depression, but now that loss has moderated, showing the end is near. We anticipate the job loss cycle will hit bottom by the end of 2009 and the economy should be poised for recovery in 2010”,Nadji said.

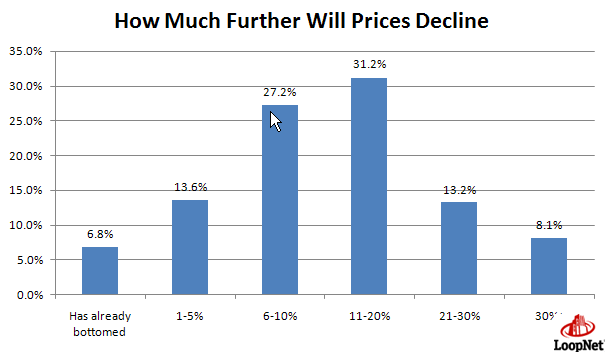

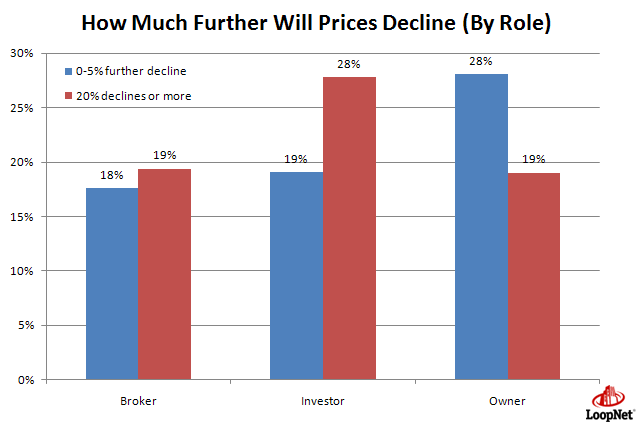

CoSatar reports that retail sales where better last month than expected, Nadji warned the retail industry to still be ready for the worst case scenario because a recovery will be “muted and difficult” and consumers will still face issues with debt and lack of jobs.

Traditionally in past recessions, consumers home-buying confidence will increase as the Feds decrease the interest rates, decreasing the duration of the recession. The affects on consumers during this recession have been much deeper than what we have experienced in the past, and the recovery is taking much longer than most economists predicted.

“The effect of store closures on retail vacancies has been incredibly sharp because retail was the only sector in which construction actually went up during 2001-2003 because there was so much consumer stimulation going,” Nadji said. CoStar expects that vacancy rates (which are extremely high) will continue to rise well in to 2010.

What Should Landlord’s Do?

Marty Mayer, president of Convington, an LA-based Stirling Properties, said “keeping existing tenants intact is key.” If a tenant moves out, there are several additional costs incurred by the landlord including leasing commissions, tenant improvements, cost of the vacancy itself.

Another option landlords should strongly consider is allowing the tenant to reduce the amount of s.f. they occupy. It may save the tenant from going dark, which will limit the amount vacancies landlords are currently battling.