In a recent survey distributed by Loopnet.com, they questioned three key groups in commercial real estate (the broker, the investor, and current property owners). The survey was to determine the confidence these groups have in when the Commercial Market will begin to turn around. Main points of interest were:

- Timing of Recovery in Transaction Volume (when will the transaction numbers begin to increase relative to 2009.)

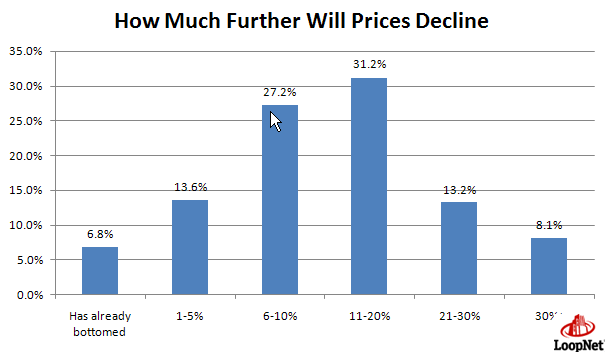

- How much further will prices decline?

- When will pricing hit bottom?

- How much further will the prices decline?

- What is the best investment opportunity?

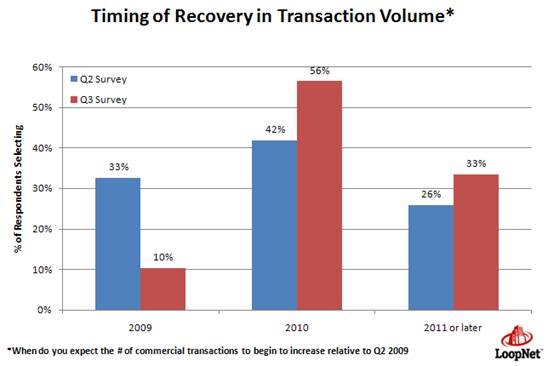

TRANSACTION VOLUME

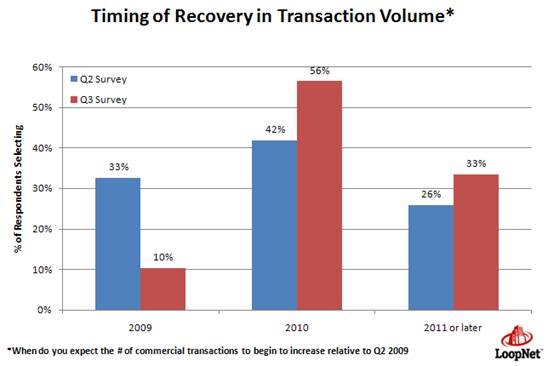

According to Loopnet, the confidence of Investors have slipped since last quarter. Only 10% feel that there will be a recovery in 2009 and 33% of the investors feel that it will be in 2011.

Although this isn’t great news, 56% of the investors feel that mid-year 2010 we should see the transaction number start to increase.

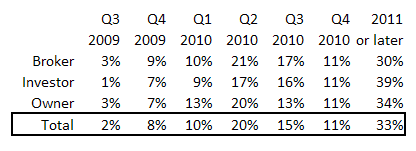

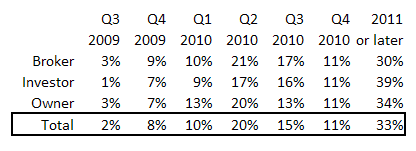

Breakdown by Quarter and Role

PRICING

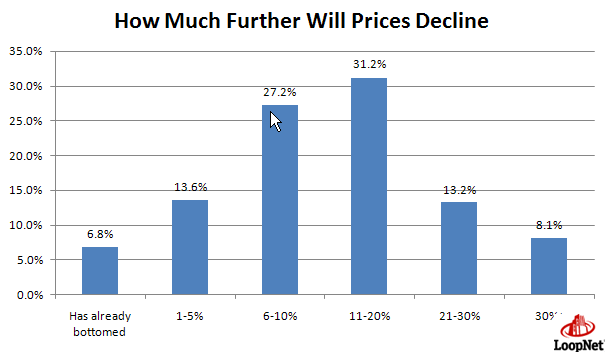

Although there is some consistency in the opinions regarding the transaction volume increasing, there is a pretty vast difference in how much further prices will decline. Of those surveyed, most believe that there is still an 11-20% drop ahead of us.

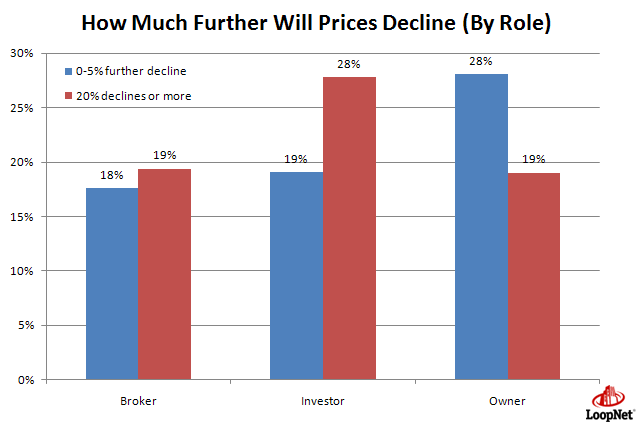

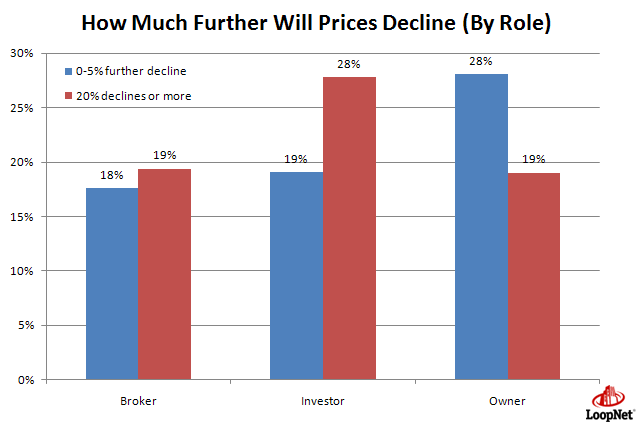

Current owners are a little more optomistic than are investors. 28% of the owners believe that pricing has bottomed out already, or will only decline 5% or less.

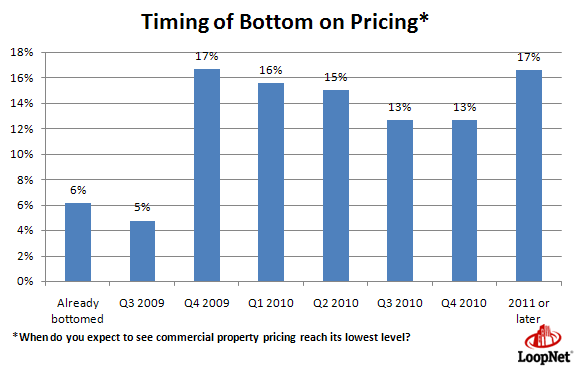

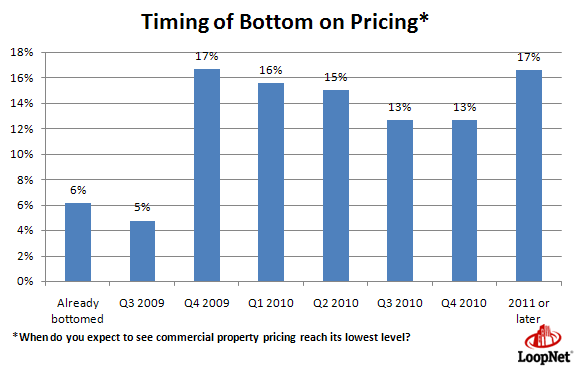

WHERE IS THE BOTTOM?

The consensus was not clear on when the pricing will completely reach the bottom, but the majority surveyed (60%) expects it to happen between Q4 of ’09 and Q3 of 2010. 17% surveyed expect that the declines will continue through 2011.

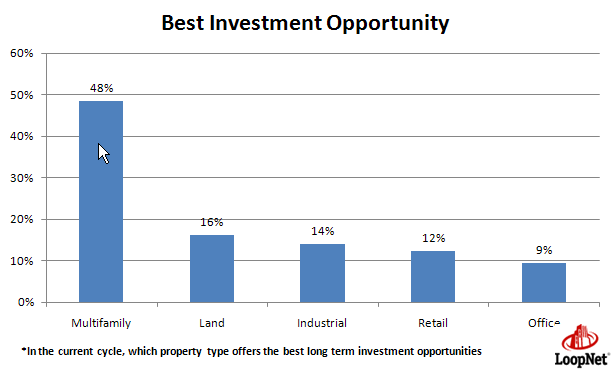

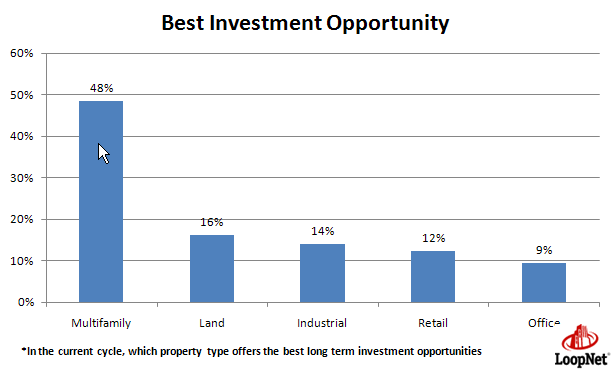

BEST INVESTMENT OPPORTUNITY

Of those surveyed, 48% felt that Multifamily was the best opportunity when considering a long term investment.

The Commercial Sector in St. George, Utah that are currently being professionally marketed in St. George Utah, there are:

- 11 Multifamily properties available for sale

- 29 Office buildings/Office condo’s for sale

- 25 Retail buildings/Retail condo’s for sale

Contact me if you are interested in viewing a list of available properties for Sale or Lease anywhere in St. George, Hurricane, Washington, or Cedar City.